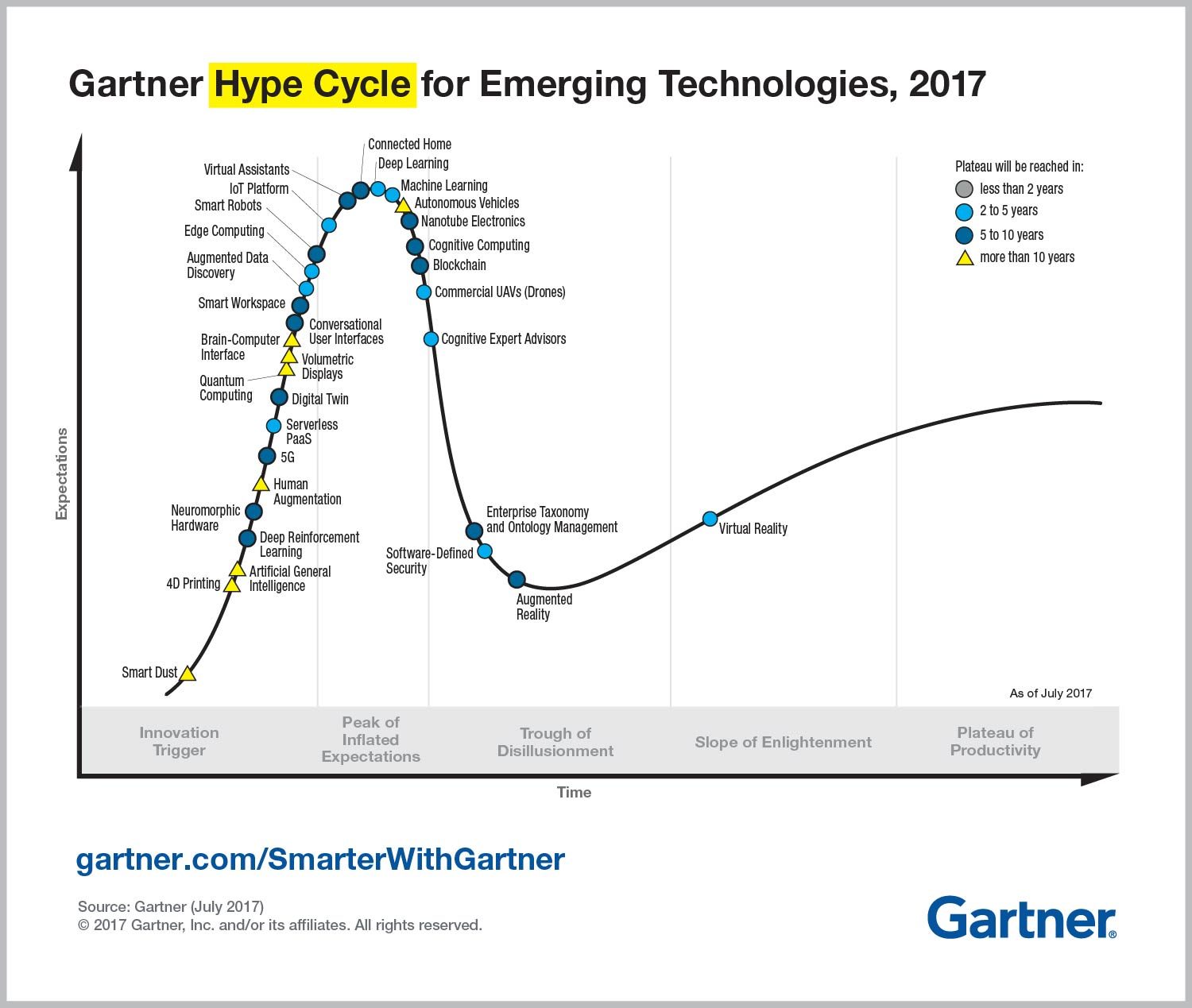

In 2020, DeFi saw lots of growth, some of it warranted, we noted last year. In short, DeFi's promise is to be able to cut out middlemen from all kinds of transactions. In 2020, blockchain-powered DeFi rose to prominence. To reiterate: the transformational potential is there, but there's still a long way to go, both on the technical and on the organizational and operational side of things. But that does not mean it's without significance. To speak in hype cycle terms, blockchain is going through the Trough of Disillusionment. The concepts and the technology are still under development, while mainstream adoption is still tentative. Blockchain's sudden rise to stardom in 2017 was rather abrupt and premature. Will 2022 be a breakout year for blockchain? Probably not. Let's get that out of the way: was 2021 a breakout year for blockchain? No, not really.

Balancing, or even defining, makers and takers in the OSS world remains controversial, and 2021 saw two more commercial OSS vendors, Elastic and Grafana, changing their licenses.īlockchain platforms are by and large open source too, but although data-related, theirs is a different story. This is a topic we first started exploring in 2019, and in 2021 we featured the CHAOSS project - the most elaborate effort we have seen to capture the value OSS communities generates. What we saw very little mainstream uptake for in 2021 was a more fine-grained way to account for the value generated via OSS. We expect this trend to continue in 2022. As Luis Ceze, OctoML CEO and founder, told ZDNet recently, there is a lot of capital flying around and being invested in OSS companies creating value.

#HYPE CYCLE 2022 SERIES#

Apollo GraphQL raised a $130 Million Series D round at a $1.5 billion valuation, Yugabyte raised a $188M Series C funding round at a $1.3B valuation, and CockroachDB raised a couple of rounds too, with the latest being a $278M Series F at a valuation of $5 billion.Īnd that's not even considering all the aspiring data and AI OSS unicorns out there, from OctoML and Edge Impulse to Superconductive and Startree. Graph database Neo4j raised a $325 million Series F funding round, the biggest in database history, bringing its valuation to over $2 billion. Plus, Confluent, another OSS behemoth, filed for an IPO.Ģ021 has also seen a few more unicorns in the OSS data world. 2021 has seen OSS behemoth Databricks raise a $1B Series G round in February, and a $1.6B Series H in August, bringing its valuation to $38 billion.

#HYPE CYCLE 2022 PLUS#

And all of those projects apply what is by now the standard playbook for OSS: a free-to-use baseline version, plus an enterprise version offered via the SaaS model in the cloud.Īnother related piece of evidence as to the prevalence of OSS and the cloud as operating models is the amount of funding received by companies built on this combination in 2021. In an OSS ecosystem that includes everything from front-end development to blockchain applications, databases and data management systems are over-represented. Throughout 2021, about 35% of the OSS projects included in the ROSS Index have been databases and data management systems, including the likes of Appwrite, Prisma, and SeMI Technologies, which we have covered in this column. The people at Runa look for promising companies with a fast-growing army of fans and keep track of them at Github as part of their investment plans.

#HYPE CYCLE 2022 SOFTWARE#

The ROSS (Runa OSS) Index is an index created and maintained by Runa Capital, a Venture Capital supporting founders who are building disrupting companies across B2B SaaS, deep tech, and software for regulated industries. In addition, how well databases and data management systems score among the fastest-growing OSS projects offers another hint.

0 kommentar(er)

0 kommentar(er)